Exploring Common Options Strategies: A Layman-Friendly Guide

Options strategies can be likened to placing various types of bets based on how you expect a stock’s price to move. Here’s a detailed, layman-friendly guide to some common options strategies:

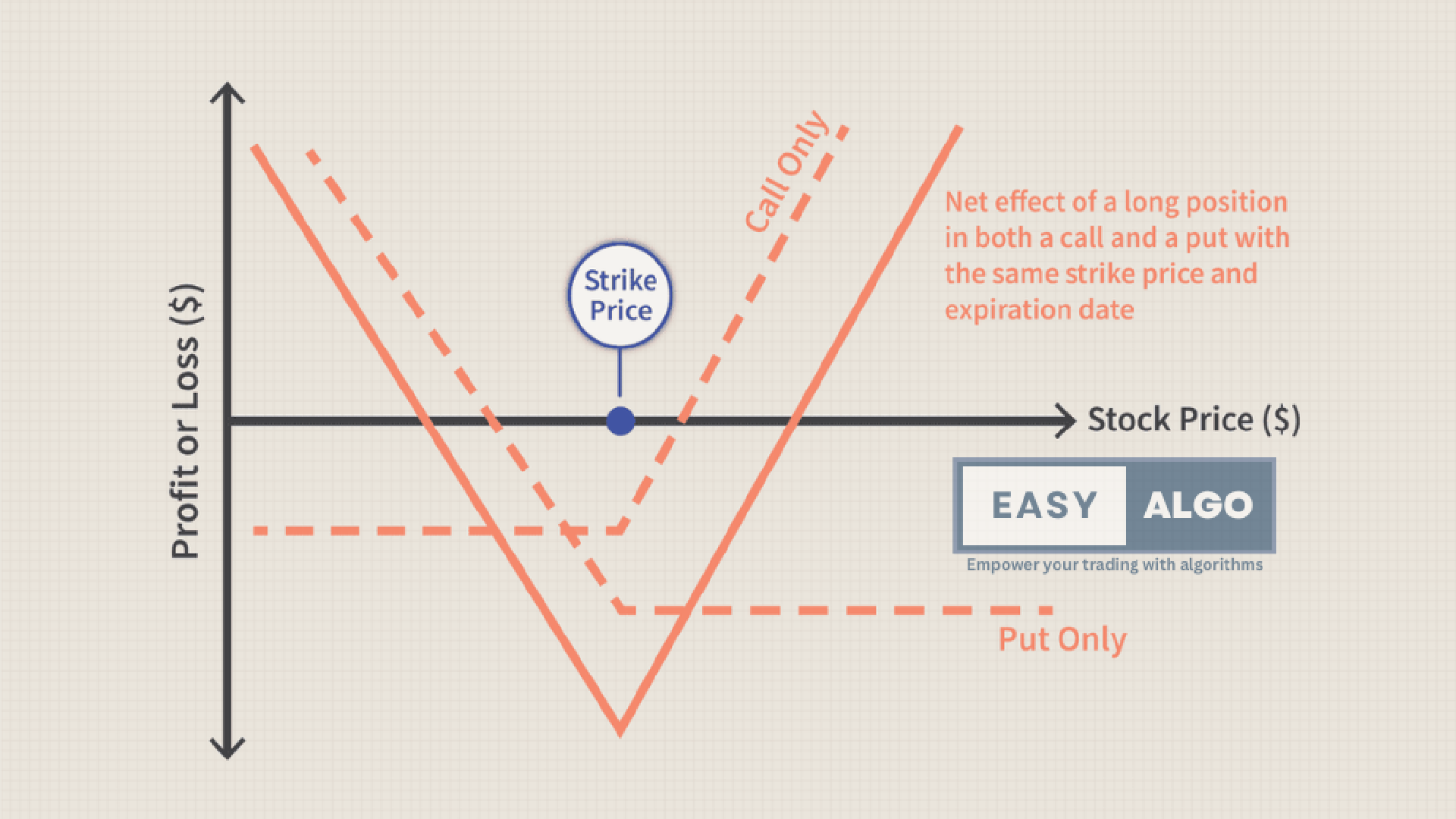

Straddle

A Straddle is like betting on a horse to either win or lose dramatically, but not stay in the middle.

- What It Is: You buy both a call option (betting the stock will go up) and a put option (betting it will go down) with the same strike price and expiration date.

- When to Use: Use this when you expect significant movement in the stock price but are unsure of the direction.

Example:

- If a stock is trading at ₹1,000, you buy a ₹1,000 call and a ₹1,000 put.

- If the stock moves to ₹1,200, the call option gains value.

- If it drops to ₹800, the put option gains value.

- If it stays around ₹1,000, you might lose the premiums paid for both options.

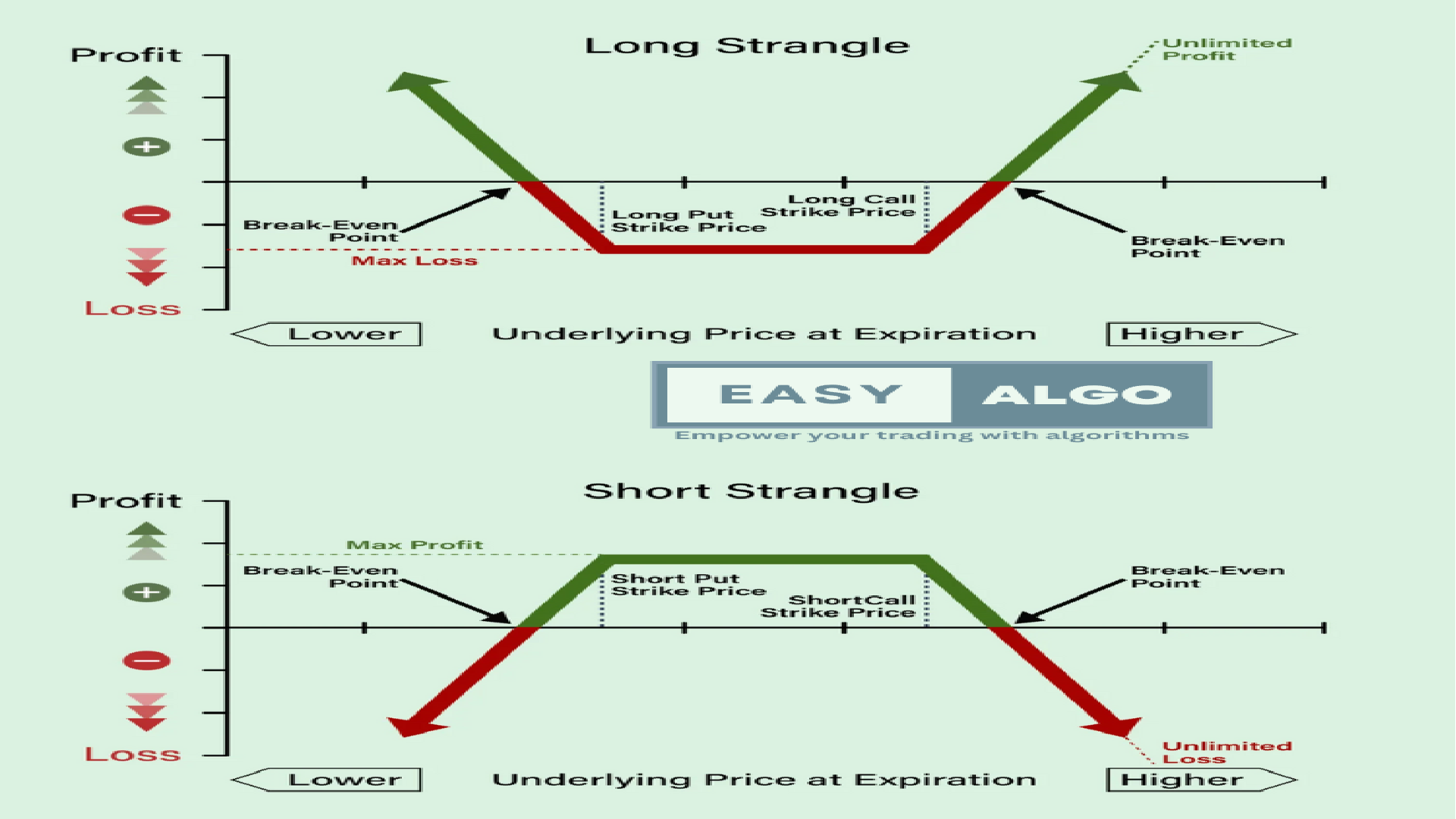

Strangle

A Strangle is like betting that a horse will finish either far ahead or far behind, but not in the middle.

- What It Is: You buy an out-of-the-money (OTM) call option (strike price above current price) and an out-of-the-money put option (strike price below current price).

- When to Use: Use this when you expect a big move but want to spend less money.

Example:

- If the stock is at ₹1,000, you buy a ₹1,100 call and a ₹900 put.

- You profit if the stock moves above ₹1,100 or below ₹900.

- If it stays between ₹900 and ₹1,100, you lose the premiums paid.

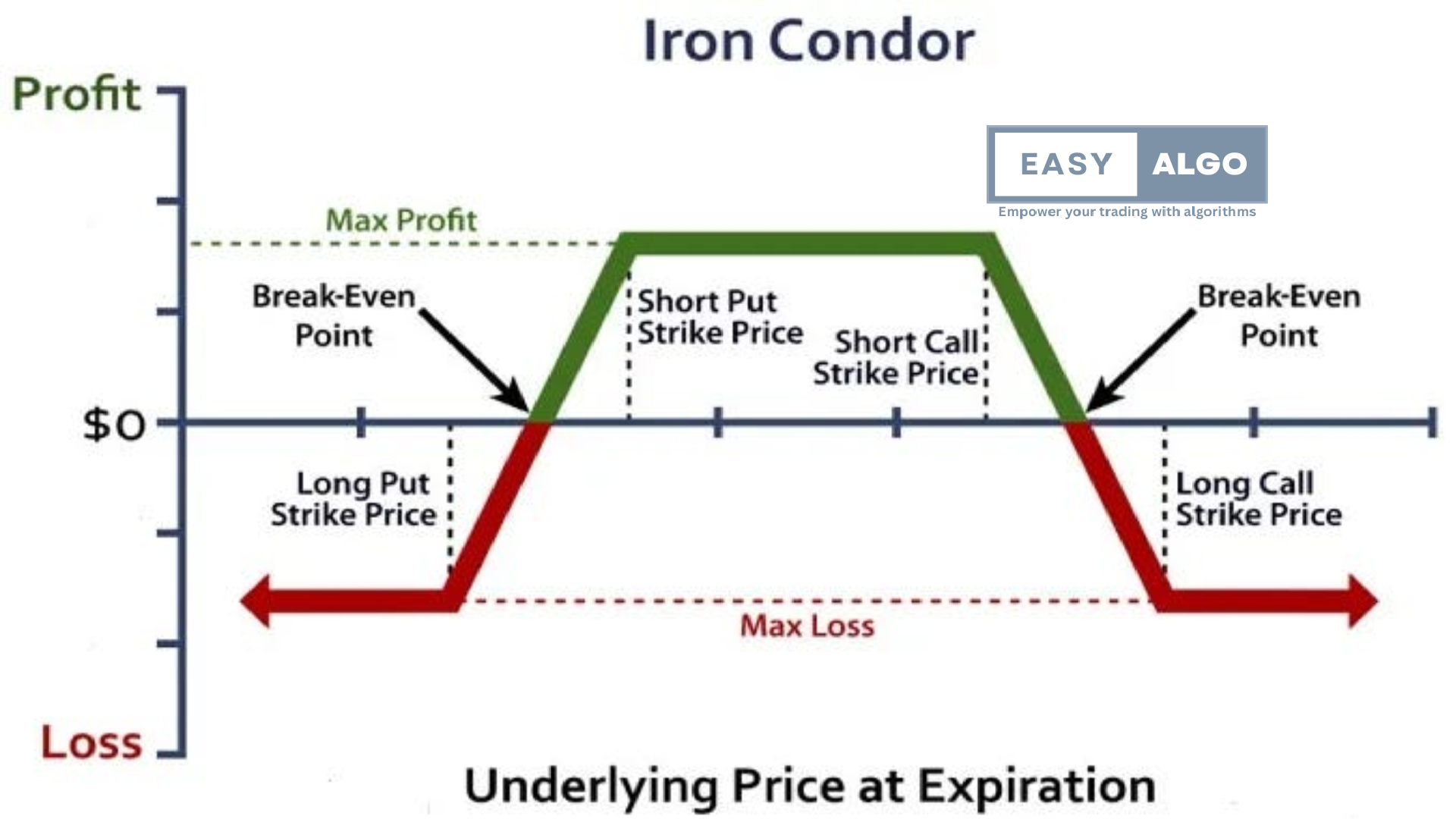

Iron Condor

An Iron Condor is like betting that a horse will finish within a specific range, not too high or too low.

- What It Is: You sell an in-the-money (ITM) call and put option (closer to current price) and buy further out-of-the-money call and put options to limit risk.

- When to Use: Use this when you expect the stock to stay within a specific range.

Example:

- If the stock is at ₹1,000, you might sell a ₹900 put and a ₹1,100 call, and buy a ₹800 put and a ₹1,200 call.

- You profit if the stock stays between ₹900 and ₹1,100.

- Losses are limited if the stock moves outside ₹800 or ₹1,200.

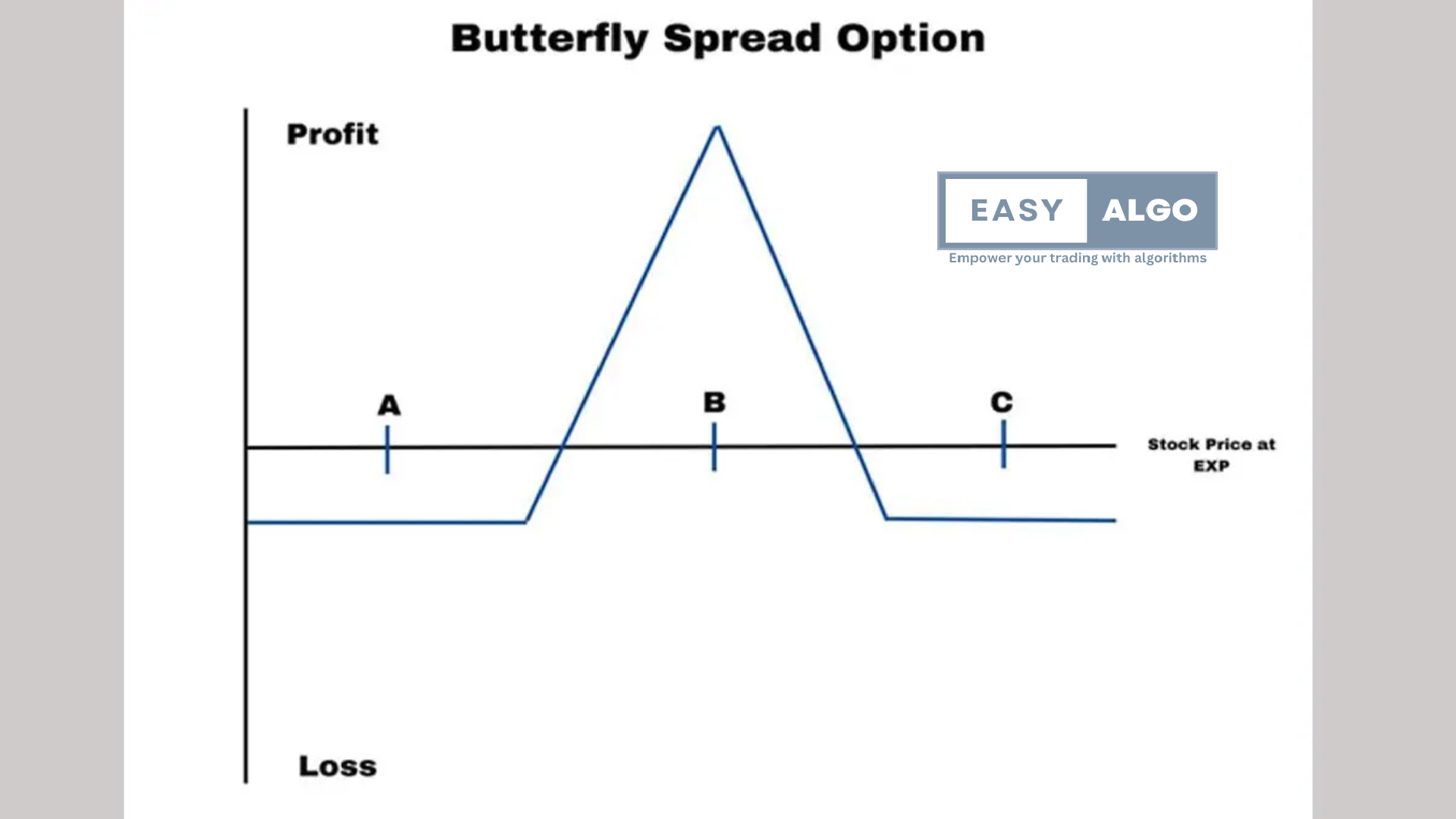

Butterfly Spread

A Butterfly Spread is like betting that a horse will finish very close to a specific position, neither too high nor too low.

- What It Is: You buy one option at a lower price, sell two options at a middle price, and buy one option at a higher price, all with the same expiration date.

- When to Use: Use this when you expect little movement in the stock.

Example:

- If the stock is at ₹1,000, you might buy a ₹900 call, sell two ₹1,000 calls, and buy a ₹1,100 call.

- Maximum profit if the stock stays near ₹1,000.

- Limited loss if it moves too far from ₹1,000.

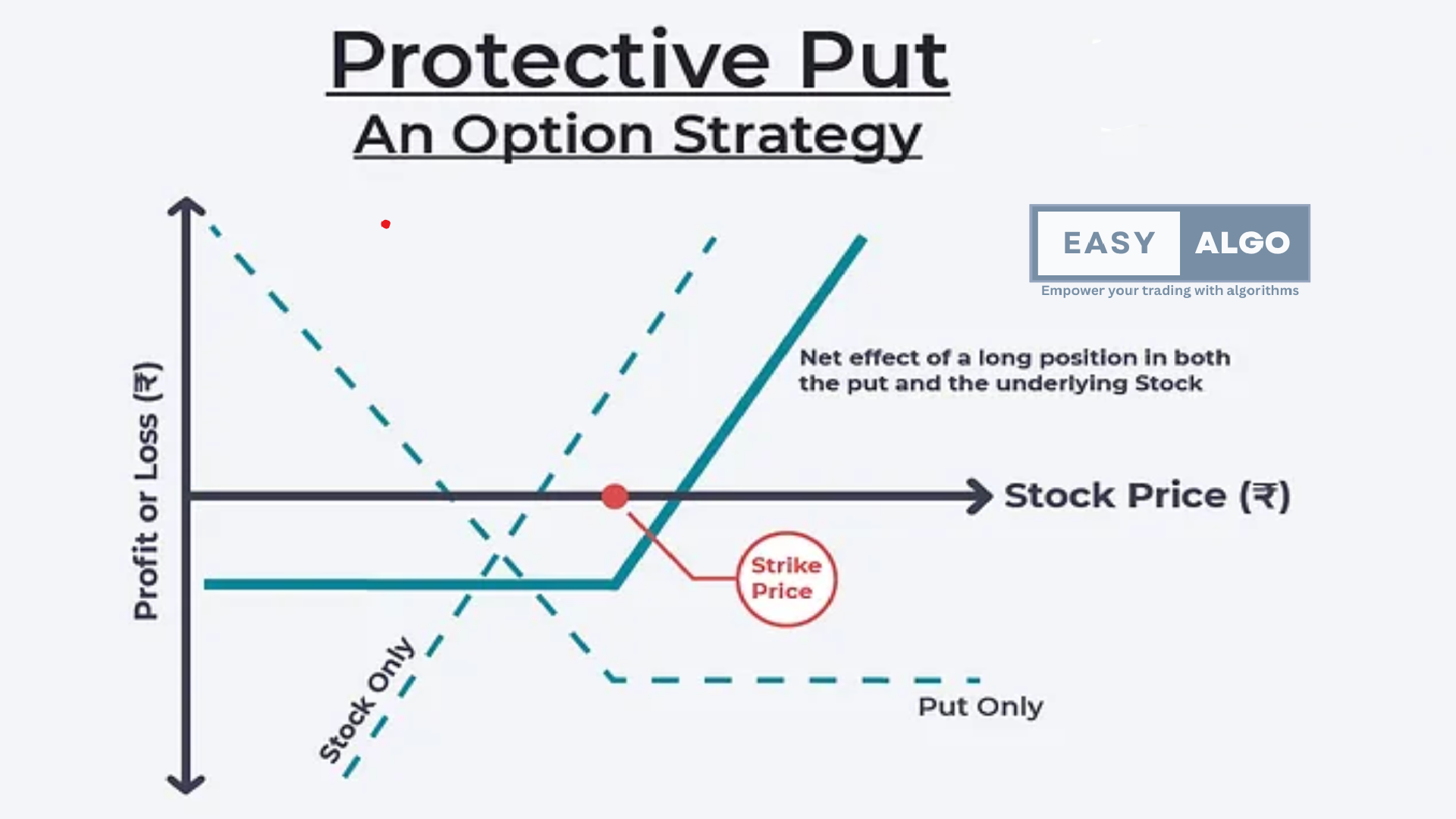

Protective Put

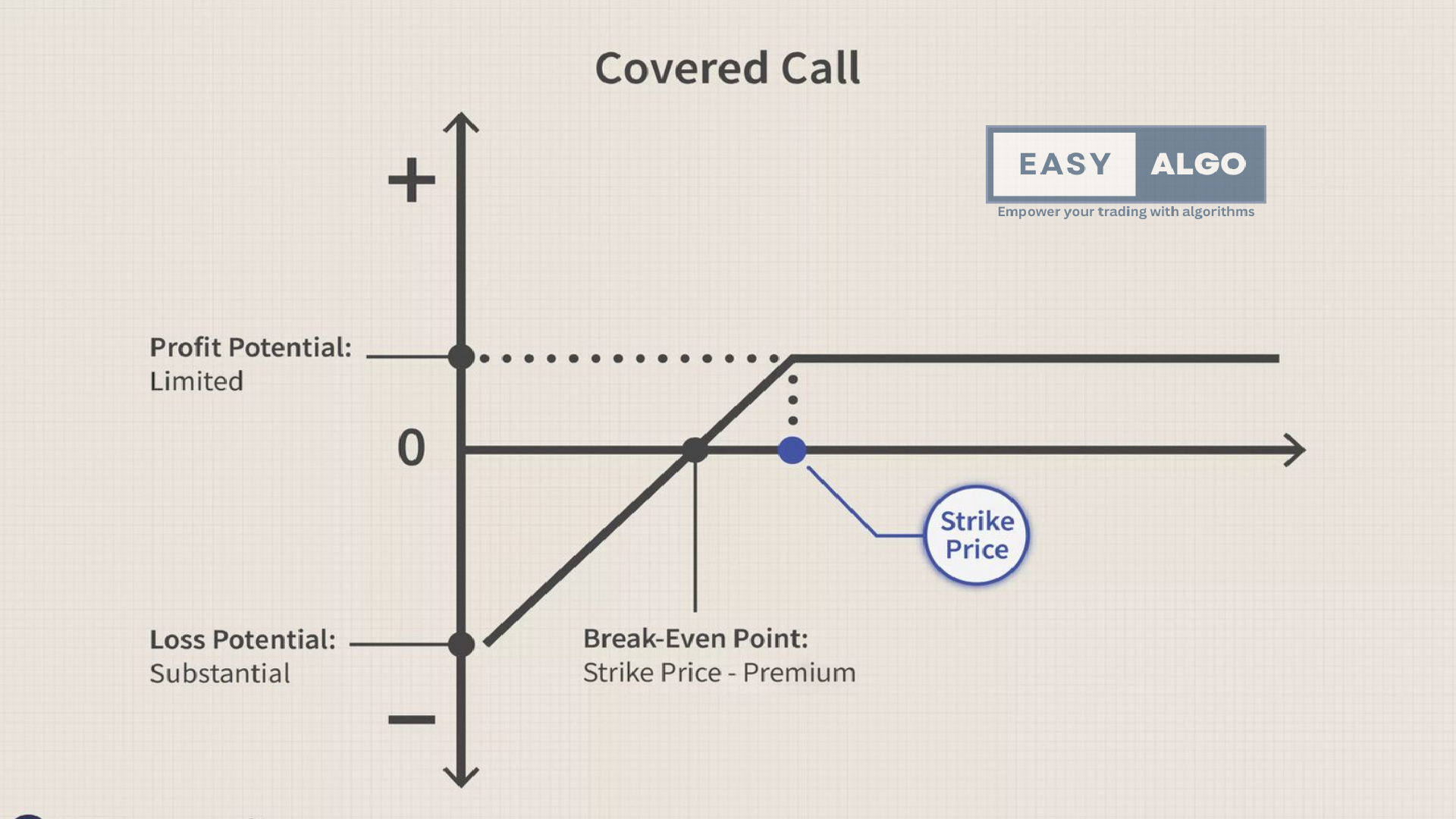

A Covered Call is like renting out your car while you’re not using it, making extra money, but agreeing to sell it if someone wants to buy it at a higher price.

- What It Is: You sell a call option on a stock you already own.

- When to Use: Use this to generate extra income if you don’t expect the stock to rise significantly.

Example:

- If you own a stock at ₹1,000, you sell a ₹1,100 call option.

- You earn the premium from selling the option.

- If the stock rises above ₹1,100, you sell it at ₹1,100, keeping the premium.

Covered Call

A Protective Put is like buying insurance for your car – you’re protecting your investment if something goes wrong.

- What It Is: You buy a put option on a stock you own to protect against a decline.

- When to Use: Use this to hedge against potential losses.

Example:

- If you own a stock at ₹1,000, you buy a ₹900 put.

- If the stock drops to ₹800, you can still sell it for ₹900 using the put.

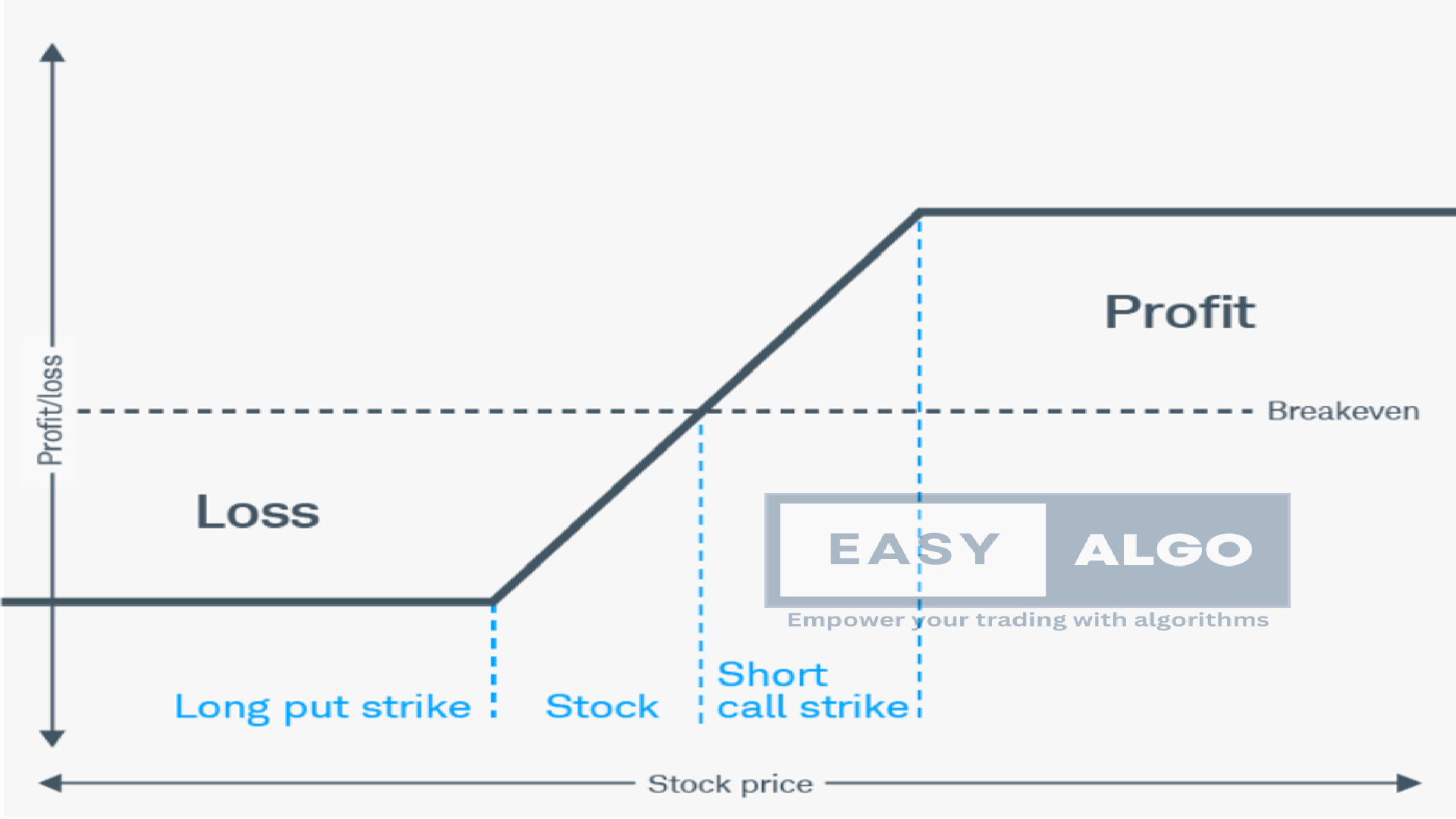

Collar

A Collar is like using a combination of safety gear – a helmet and knee pads – to limit how much you can get hurt.

- What It Is: You buy a put option to limit downside risk and sell a call option to limit upside potential.

- When to Use: Use this to protect against significant losses while capping gains.

Example:

- Own a stock at ₹1,000.

- Buy a ₹900 put to limit losses.

- Sell a ₹1,100 call to cap gains but earn the premium.

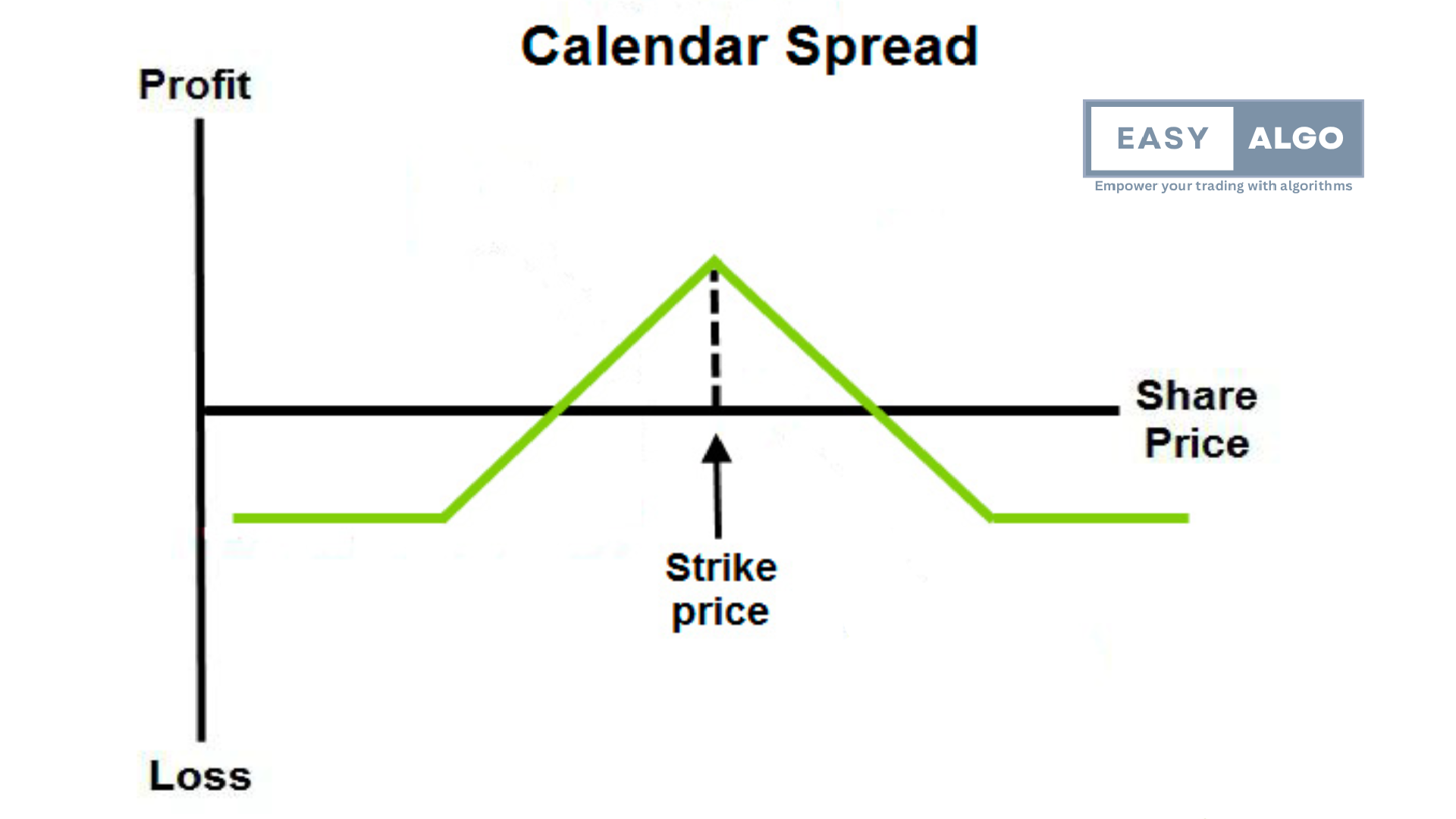

Calendar Spread

A Calendar Spread is like making two bets on the same horse in different races – one in a short race and one in a longer race.

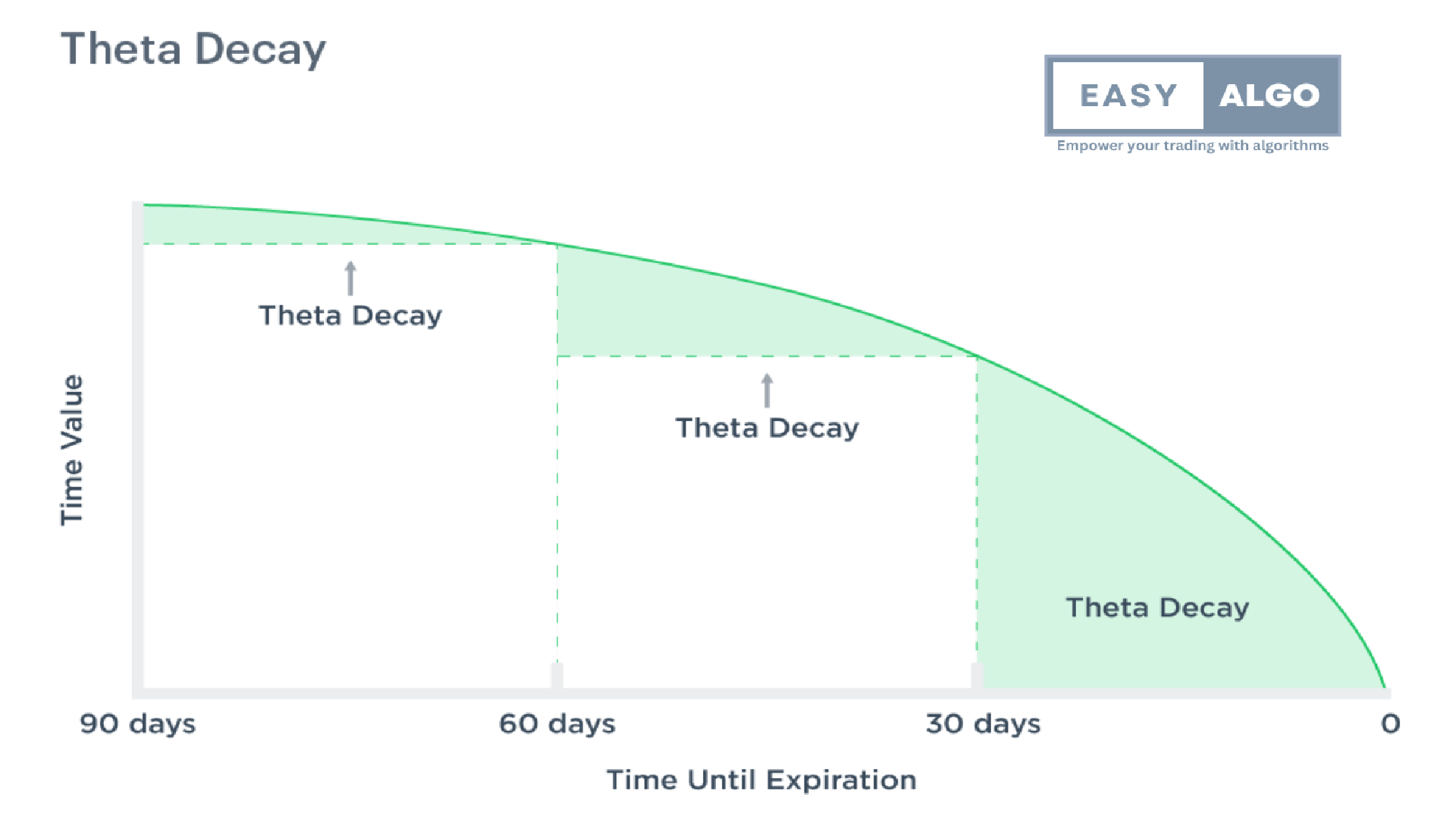

- What It Is: You buy and sell options with the same strike price but different expiration dates.

- When to Use: Use this when you expect little movement in the short term but more movement later.

Example:

- If the stock is at ₹1,000, you might sell a ₹1,000 call expiring in one month and buy a ₹1,000 call expiring in three months.

- You profit if the stock stays around ₹1,000 in the short term.

Diagonal Spread

A Diagonal Spread is like betting on a horse in different races with slightly different odds.

- What It Is: You buy and sell options with different strike prices and different expiration dates.

- When to Use: Use this to take advantage of time and price movement.

Example:

- If the stock is at ₹1,000, you might sell a ₹1,100 call expiring in one month and buy a ₹1,200 call expiring in three months.

- Profits from both time decay and expected movement.

Factors Affecting Option Premiums

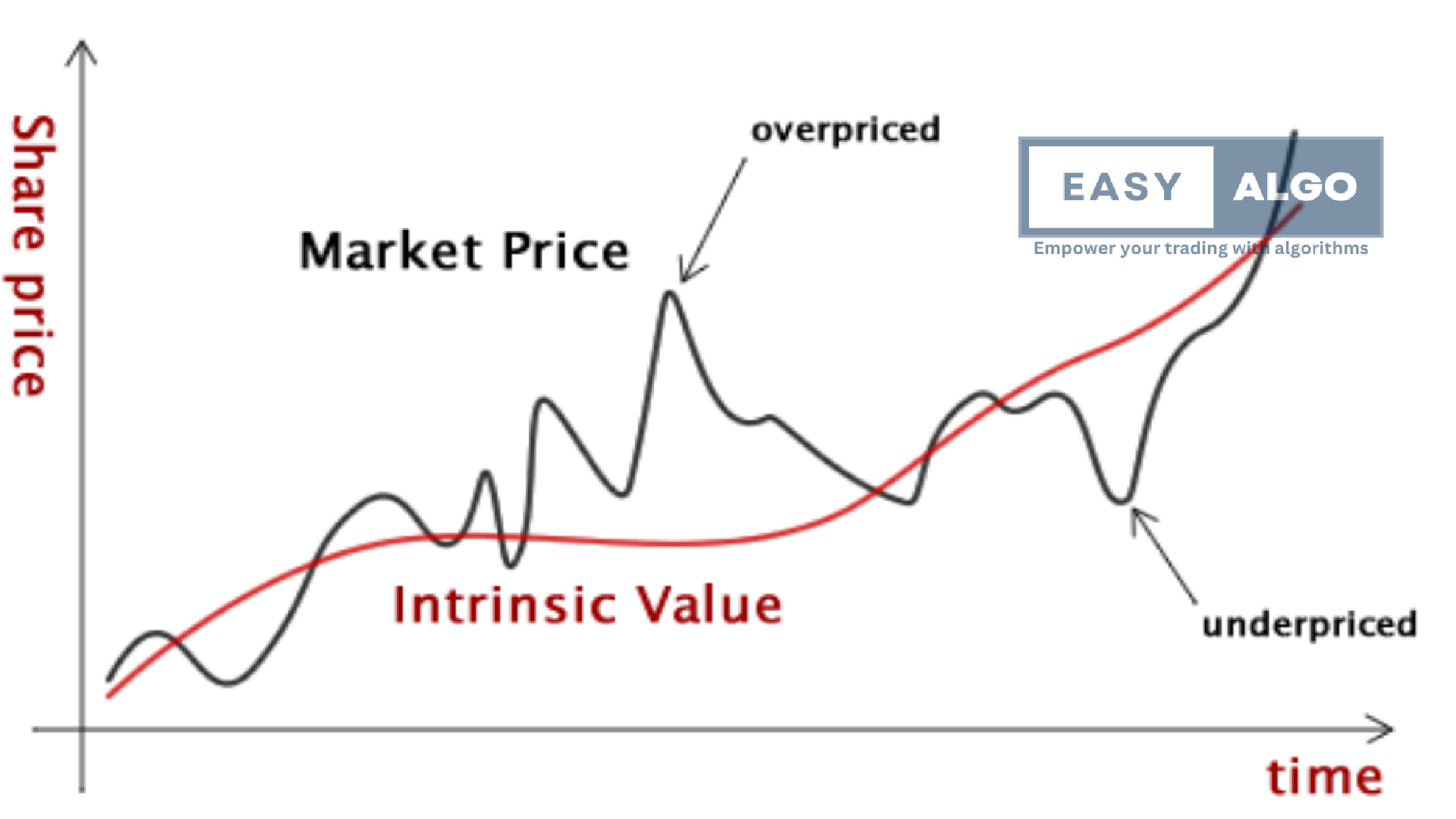

Intrinsic Value

Intrinsic value is the actual, built-in value of an option if exercised right now.

Example:

- For a call option, if a stock is ₹1,200 and you have a ₹1,000 call, the intrinsic value is ₹200.

- For a put option, if a stock is ₹800 and you have a ₹1,000 put, the intrinsic value is ₹200.

Time Value

Time value is the extra cost of an option because of the time remaining until it expires.

Example:

- If a stock is ₹1,000 and a call option with a strike price of ₹1,100 is worth ₹30, but the intrinsic value is ₹0, the ₹30 is entirely time value.

Volatility

Volatility reflects how much the stock price is expected to move. Higher volatility increases the option's price because of the higher chance of significant price changes.

Interest Rates

Interest rates impact the cost of holding options, especially for longer-term options. Higher rates increase call option premiums and decrease put option premiums.

Dividends

Dividends paid on the underlying stock can reduce call option prices and increase put option prices.

Theta Decay

Theta decay is the rate at which an option loses its value as it approaches expiration. The closer to expiration, the faster the decay, especially for at-the-money (ATM) options.

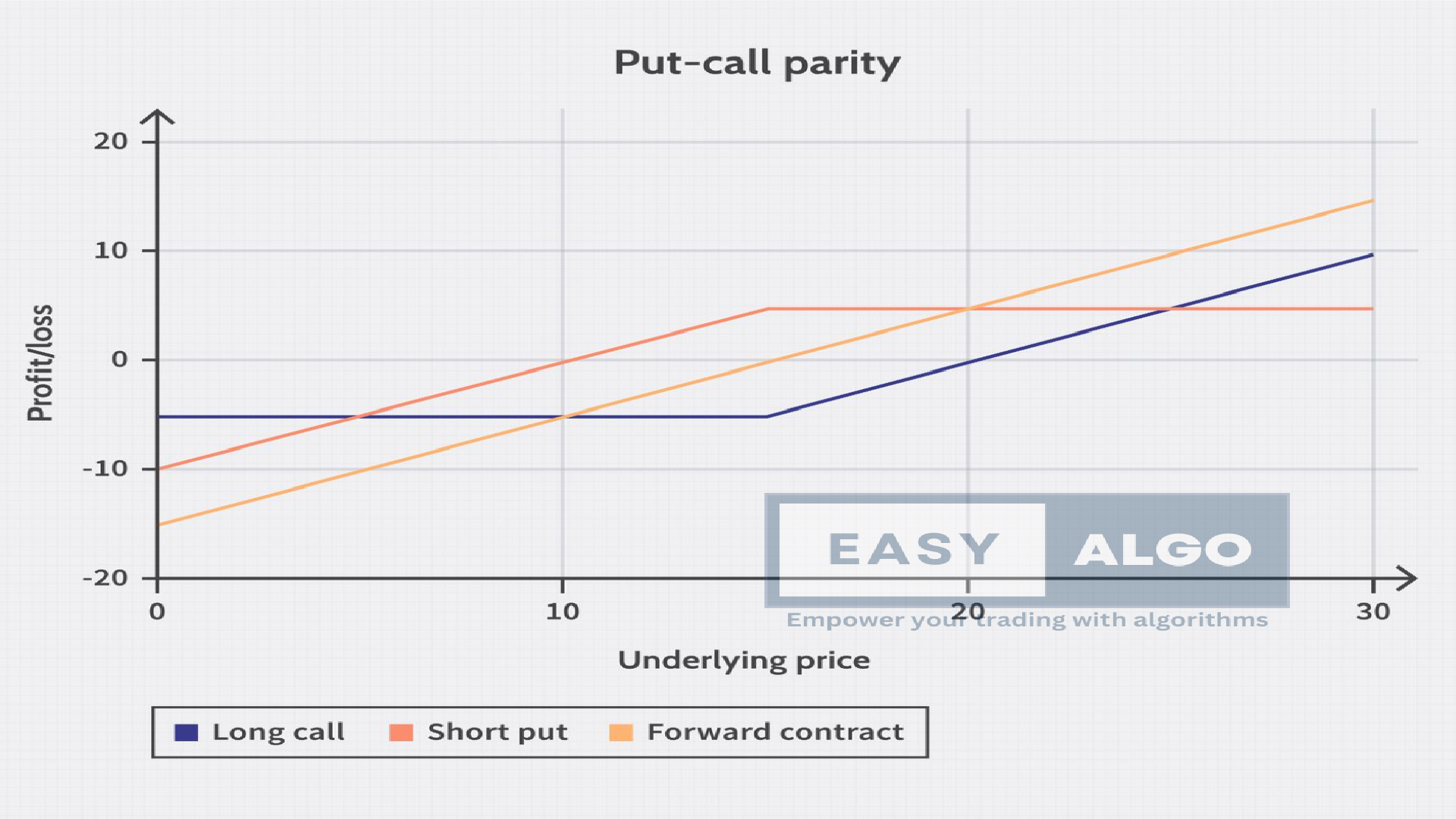

Hedging in Options Trading: Understanding Put-Call Parity

Hedging with options is a way to protect your investments against adverse price movements. A crucial concept in this context is Put-Call Parity.

What is Put-Call Parity?

Put-Call Parity links the prices of European call and put options on the same underlying asset with the same strike price and expiration date. It shows that holding a call option and cash equivalent to the strike price (or bond) is equivalent to holding a put option and the underlying stock.

Mathematical Formula:

- C−P=S−K×e −rT

Where:

- C= Price of the call option

- P= Price of the put option

- S= Current price of the underlying stock

- K= Strike price of the options

- r= Risk-free interest rate

- T= Time to expiration

Simplified Version:

C−P=S−K (When ignoring interest rates and dividends for simplicity.) Key Insight: This formula shows that the difference in the price of a call and a put option is equal to the difference between the current stock price and the strike price.

How Put-Call Parity Helps in Hedging

1. Creating Synthetic Positions

Put-Call Parity can help you create synthetic positions to hedge your investments.

Synthetic Long Stock:

- What It Is: Create a position equivalent to holding the stock by buying a call option and selling a put option with the same strike price.

- Why: Mimics stock ownership without buying the stock.

Example:

- If a stock is at ₹1,000, buy a ₹1,000 call and sell a ₹1,000 put.

- This position behaves like owning the stock.

Synthetic Short Stock:

- What It Is: Create a position equivalent to shorting the stock by buying a put option and selling a call option with the same strike price.

- Why: Protects against or profits from a stock's decline without shorting it directly.

Example:

- If the stock is at ₹1,000, buy a ₹1,000 put and sell a ₹1,000 call.

- This position benefits from a drop in the stock price.

.png)

Hedging Strategies Using Put-Call Parity

Protective Put (Insurance for Stocks)

- What It Is: Buy a put option on a stock you own.

- How It Helps: Limits the downside risk of your stock falling below the strike price.

Example:

- You own a stock at ₹1,000.

- Buy a ₹900 put option.

- If the stock drops to ₹800, you can still sell it for ₹900 using the put.

Covered Call (Income from Stocks)

- What It Is: Sell a call option on a stock you own.

- How It Helps: Earns extra income from the option premium, but you might have to sell your stock if the price rises above the strike price.

Example:

- You own a stock at ₹1,000.

- Buy a ₹900 put to limit losses.

- Sell a ₹1,100 call to cap gains but earn the premium.

Synthetic Short Stock:

- What It Is: Create a position similar to shorting the stock by buying a put and selling a call at the same strike price.

- How It Helps: Protects against or profits from a stock's decline without shorting it directly.

Example:

- If the stock is at ₹1,000, buy a ₹1,000 put and sell a ₹1,000 call.

- Profit from a fall in stock price without shorting it directly.

Understanding these strategies can help you make informed decisions in options trading, protecting your investments and potentially enhancing your returns.