Understanding Option Chain in the Indian Market

Introduction to Option Chain in Indian Market

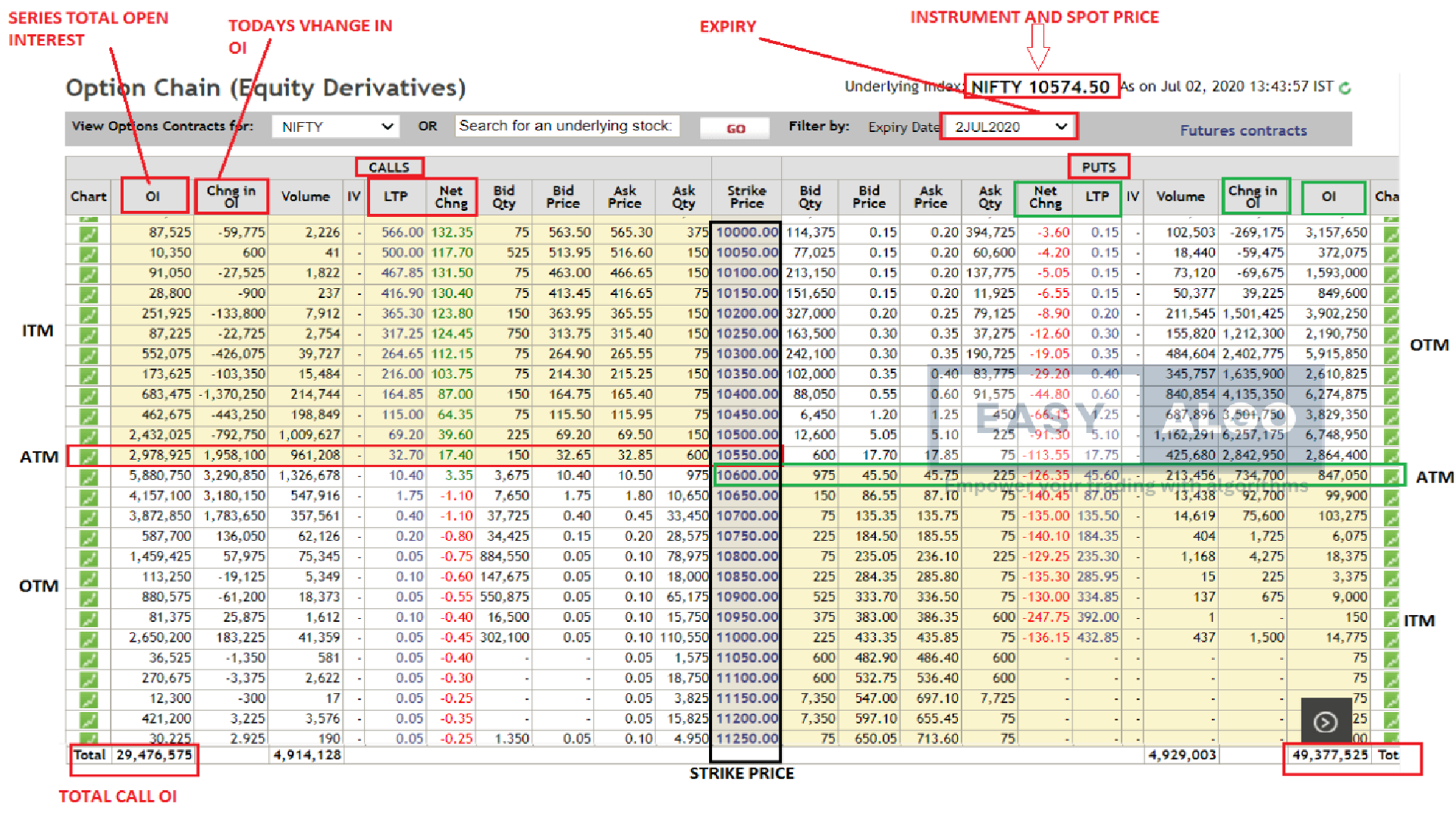

- Explain the concept of an option chain.

- Learn how to use open interest to determine support and resistance levels.

- Develop strategies based on the option chain data.

What is an Option Chain?

- An option chain, also known as an option matrix, is a listing of all available options contracts for a particular security.

- It includes details such as strike prices, expiration dates, and premiums for both call and put options.

Components of an Option Chain:

- Strike Price: The price at which the option can be exercised.

- Expiration Date: The date on which the option expires.

- Premium: The cost of purchasing the option.

- Open Interest: The total number of outstanding option contracts.

Understanding Open Interest (OI)

Definition:

Open Interest (OI) is the total number of outstanding contracts that are held by market participants at the end of the trading day.

Significance:

- Indicates the liquidity of the options.

- Helps in identifying market trends and potential price movements.

- Higher OI suggests higher liquidity and market interest.

Using Open Interest to Identify Support and Resistance

Support:

- A level where the price tends to find support as it is going down.

- High OI at a particular strike price of Put Options usually indicates strong support levels.

Resistance:

- A level where the price tends to find resistance as it is going up.

- High OI at a particular strike price of Call Options usually indicates strong resistance levels.

Practical Example: Identifying Support and Resistance

Example:

- Suppose NIFTY is trading at 15000.

- High OI at 14500 Put Options suggests strong support at 14500.

- High OI at 15500 Call Options suggests strong resistance at 15500.

Developing Strategies Using Option Chain Data

Title: Strategies Based on Option Chain Data

Bullish Strategies:

- Long Call: Buy Call Options at a lower strike price expecting the stock to rise.

- Bull Call Spread: Buy Call Options at a lower strike price and sell Call Options at a higher strike price.

Bearish Strategies:

- Long Put: Buy Put Options at a higher strike price expecting the stock to fall.

- Bear Put Spread: Buy Put Options at a higher strike price and sell Put Options at a lower strike price.

Neutral Strategies:

- Straddle: Buy both Call and Put Options at the same strike price and expiration date.

- Strangle: Buy both Call and Put Options at different strike prices but same expiration date.

Practical Example: Creating a Strategy

Scenario:

- NIFTY is currently trading at 15000.

- High OI at 14500 Put and 15500 Call.

Strategy: Bull Call Spread

- Buy 15000 Call - Expecting upward movement.

- Sell 15500 Call - To offset the premium paid for 15000 Call.

In this scenario, coincidentally, support and resistance are at the same place. If both support and resistance are strong, you can make a short straddle or short strangle. However, according to my view, a short strangle will be better as the resistance is not much stronger and may shift to 23600, and support is not much stronger and may shift to 23400 from 23500. Using a short straddle might be risky.

Additional Insights

To enhance your understanding and application of option chains in the Indian market, consider the following:

- Monitor Market Trends: Regularly check the option chain for significant changes in open interest, which can indicate shifts in market sentiment.

- Use Technical Analysis: Combine option chain data with technical analysis tools to make more informed trading decisions.

- Stay Informed: Keep up-to-date with market news and events that could impact option prices and open interest levels.

- Stay Informed: Keep up-to-date with market news and events that could impact option prices and open interest levels.

- Risk Management: Always have a risk management strategy in place to protect your investments from significant losses.

By mastering the use of option chains and understanding the implications of open interest, you can develop effective trading strategies and improve your market analysis skills.