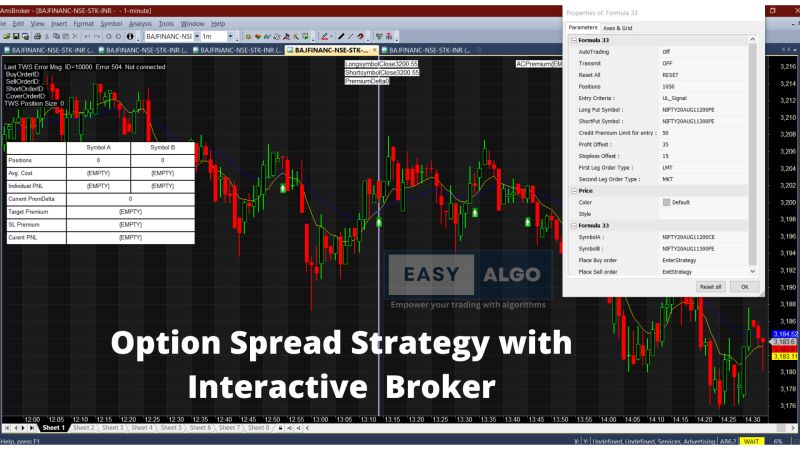

Option spread strategy is a popular options trading technique that involves simultaneously buying and selling two or more options of the same underlying asset with different strike prices and/or expiration dates. The goal of the strategy is to reduce risk and increase the probability of profit by creating a spread between the purchase price and the sale price of the options. At EasyAlgo, we specialize in automating trading strategies and backtesting them to ensure maximum profitability. If you have a trading idea but don't know how to automate it, or if you want to backtest your trading strategy but don't know where to start, contact us at +91-8851987919 or visit our website at easyalgo.in. Option spread trading can be used to take advantage of a variety of market conditions, including bullish, bearish, and neutral markets. It can also be used to manage risk by limiting potential losses and reducing volatility. However, option spread trading can be complex and requires careful analysis and risk management. Don't miss out on the potential profits that come with trading smarter, not harder. Let EasyAlgo help you take your trading strategy to the next level. Contact us today to learn more about how we can help you automate and backtest your trading strategies for maximum profitability.