Understanding Theta in Options and How Algo Trading Can Help

Theta is one of the key Greeks in options trading.

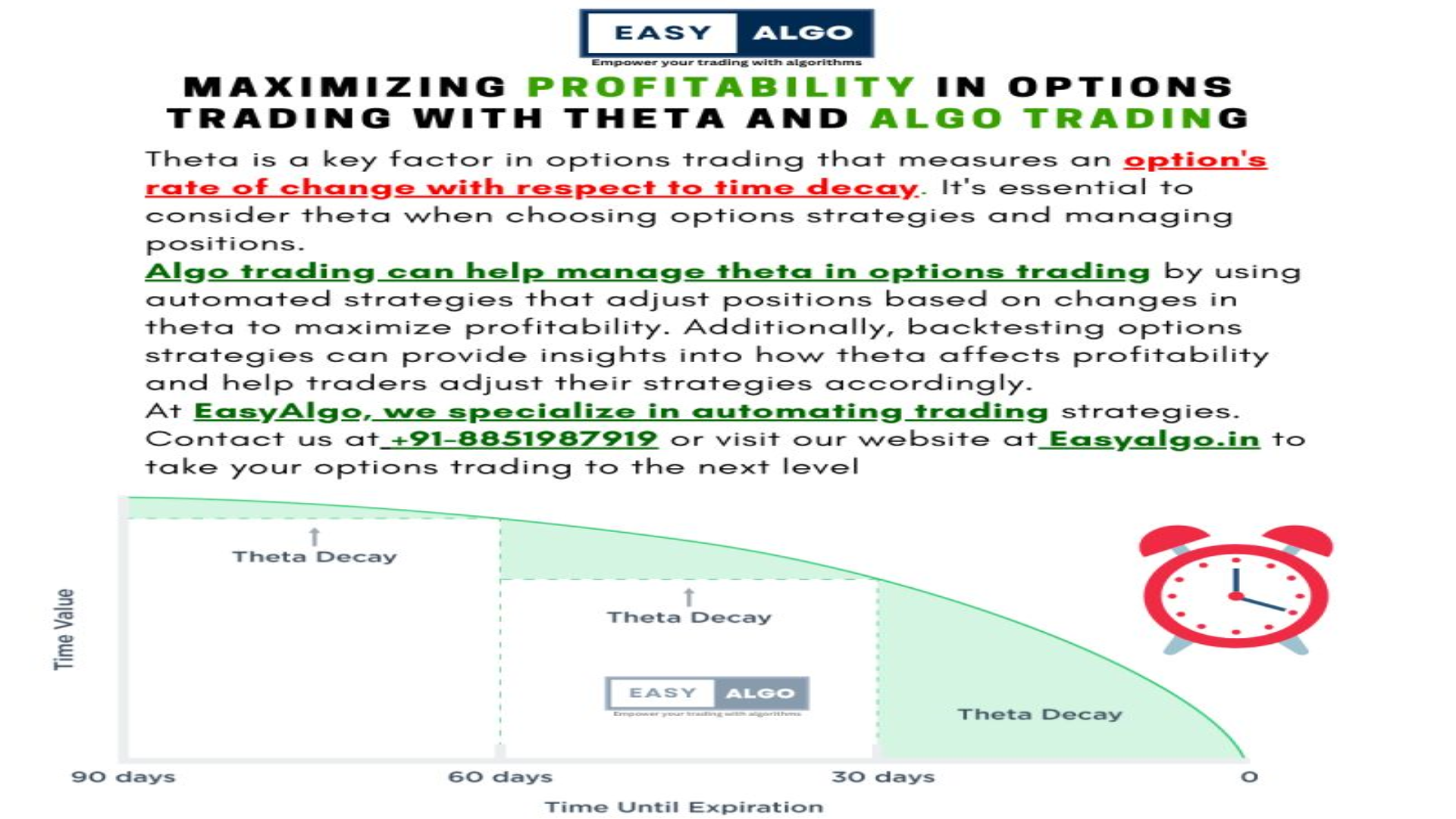

It represents the rate of change of an option's

price with respect to time decay. In other words, it measures how much an option's value will

decrease as time passes.

Theta is important in options trading because it affects the profitability of an options strategy.

As an option approaches its expiration date, its theta increases, which means that the option will

lose value more rapidly.

Therefore, traders need to take theta into account when choosing an options

strategy and managing their positions.

Algo trading can help in managing theta in options trading.

One way is to use automated trading

strategies that take theta into account when making trading decisions. These algorithms can monitor

options positions and adjust them based on changes in theta to maximize profitability.

Additionally, algo trading can help with backtesting options strategies to see how they would have

performed in the past.

By testing different options strategies on historical data, traders can gain

insights into how theta affects profitability and adjust their strategies accordingly.

At EasyAlgo, we specialize in automating trading strategies and backtesting them to ensure maximum

profitability in options trading.

If you want to manage your options positions more effectively or

backtest your options strategies, contact us at +91-8851987919 or visit our website at easyalgo.in .

In conclusion, understanding theta is crucial in options trading, and algo trading can help manage

it effectively.

By using automated trading strategies and backtesting, traders can optimize their

options positions and maximize profitability.

Don't miss out on the potential profits that come with

trading smarter, not harder.

Let EasyAlgo help you take your options trading to the next level.