When conducting backtesting, there are several key performance metrics that you should monitor to

evaluate the effectiveness of a trading strategy.

Here are some of the most important measures you

should consider:

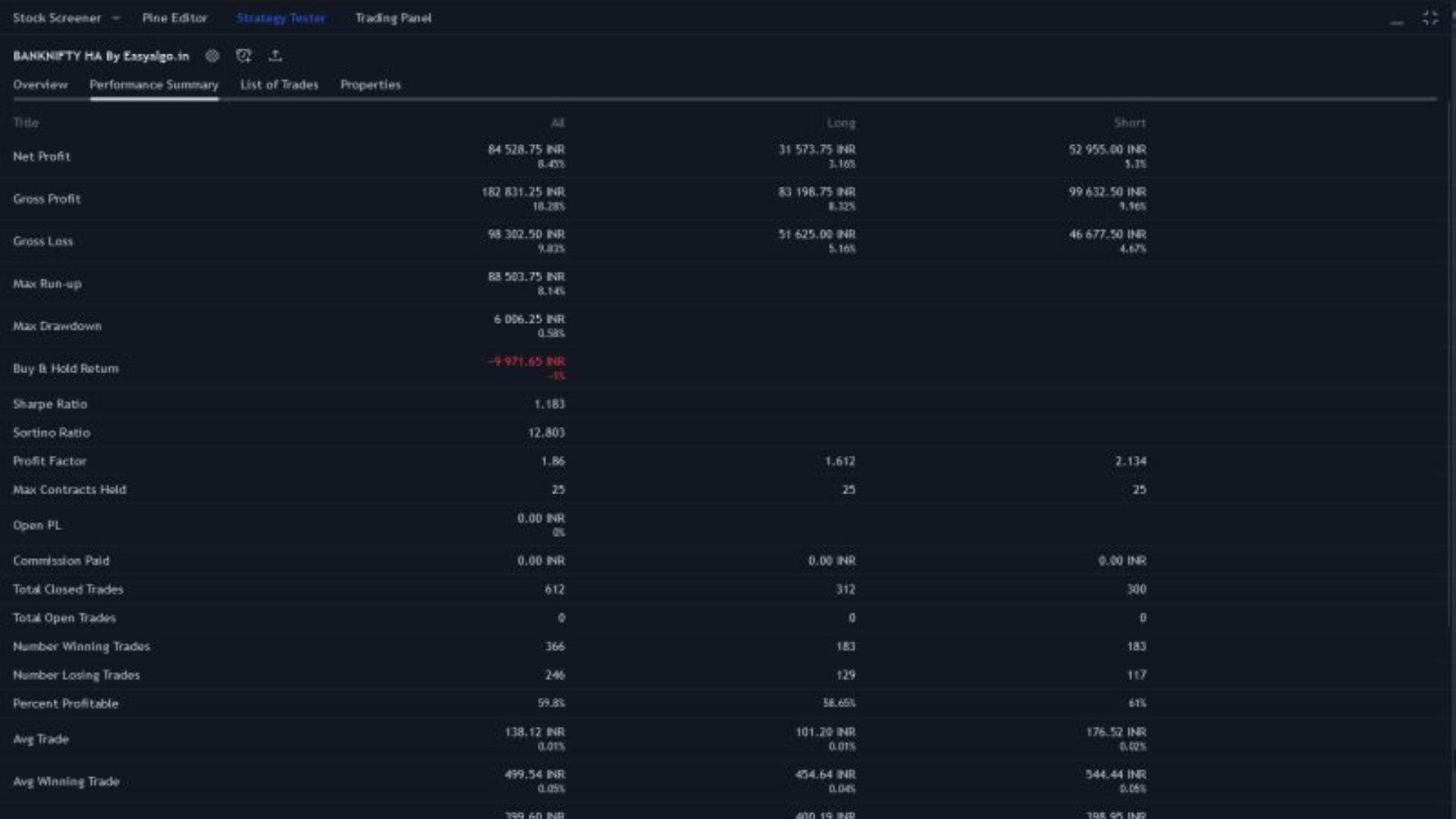

CAR (Compound Annual Return): This is the average annual rate of return on your investment over the

entire backtesting period.

Drawdown: This is the maximum percentage loss from the peak value of your investment during the

backtesting period.

This is important to monitor because it can help you manage risk and avoid large

losses.

Win Ratio: This is the number of winning trades divided by the total number of trades.

A high win

ratio is generally considered a positive indicator, but it should be interpreted in the context of

other performance metrics.

Winning Percentage: This is the percentage of winning trades out of the total number of trades.

This

metric is useful for evaluating the effectiveness of your entry and exit strategies.

Sharpe Ratio: This is a measure of risk-adjusted return.

It takes into account the amount of risk

taken to achieve a certain level of return, and is calculated by dividing the difference between the

expected return and the risk-free rate by the standard deviation of the returns.

Sortino Ratio: This is similar to the Sharpe Ratio, but it only considers downside risk (i.e. the

risk of losses).

This metric is useful for evaluating strategies that prioritize risk management.

Maximum Drawdown Duration: This is the length of time it takes for your investment to recover from

its maximum drawdown.

This metric is useful for evaluating the resilience of a trading strategy over

time.

These are just a few of the key metrics that you should monitor when conducting backtesting.

It's

important to consider them in combination with each other to get a more complete picture of the

performance of your trading strategy.

If you have a trading idea but don't know how to automate it or want to backtest your strategy,

contact us at +91-8851987919 or visit our website easyalgo.in.